The customer acquisition cost (CAC) is the result of the sum of the investments made in marketing and sales divided by the number of customers gained in the same period. It is an essential metric to measure the financial health of a company.

Indications and networking. In my professional experience, those used to be the two main sources of clients for marketing companies. Happy customer indicating another customer and contact made at an event or course are excellent sources. Do you also think like this? So far so good. The problem begins when these are the only sources of new customers. Why? Because they cost a lot!

You, as an agency manager, have you already put on paper how much you would be willing to pay for a new client? The problem with not knowing how much we are spending on a prospect is also not knowing if that client is worth it. And that can be dangerous for your business. The result can be a company full of clients, you exhausted and the accounts almost always static or negative.

Here are some concepts and tips that can help you in the search for new practices. Let’s start with the Acquisition Cost.

Cost of Acquisition (CAC)

Here at RD Station, we work a lot with the Cost of Acquisition (CAC) concept. It is an essential financial concept for the health of a company and fully applicable to the business model of service providers, such as Marketing agencies and consultants.

Customer Acquisition Cost is the set of investments made to convince a prospect to become a customer.

By defining a specific period for analysis, such as a certain month or year, the CAC can be calculated in a simple way:

CAC = (everything invested in marketing + everything invested in sales) / number of clients conquered

Marketing, sales, search, all these expenses are added in this calculation. To give you a clearer idea, in an agency we could list the following expenses:

- Hours of a manager in the negotiation and initial meetings.

- Travel hours for meetings.

- Gasoline and vehicle depreciation.

- Hours of an analyst making diagnosis.

- Telephone costs.

- Hours of a seller at closing (or a manager in the role of seller).

- Cost of structure.

- Sponsored link campaigns.

- Participation in associations, fairs and events for prospecting.

In short, everything that is done to attract a new business. But that measurement only makes sense if it is related to some others, and I am going to prioritize two: Lifetime Value (life cycle value) and ROI – Return on Investment (return on investment).

Lifetime value (LTV) – life cycle value

The Lifetime Value or value of the customer’s life cycle, refers to all the value granted by the customer during the relationship with the company. That is, the money that comes in. In the agency that means the length of the contract and the possibilities beyond it. We could make a list:

- Investment in project

- Monthly fee

- Commission on Media and Networks

- Commission on production

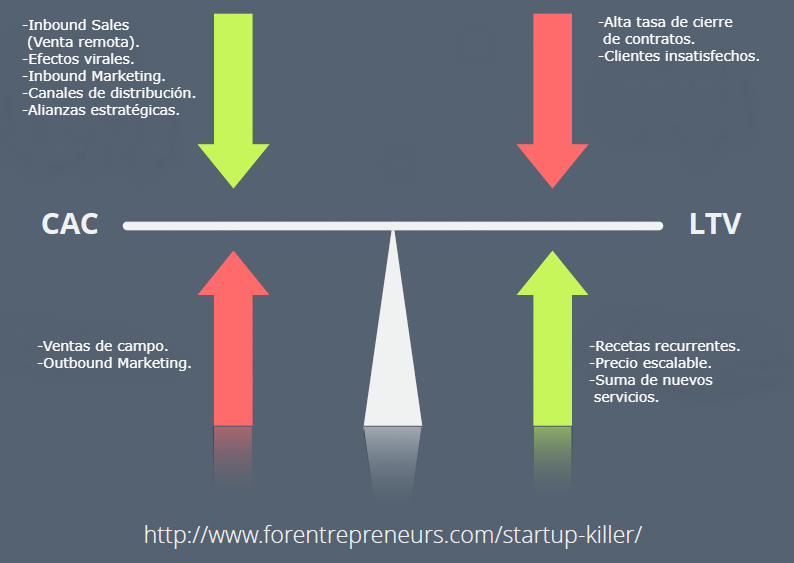

So with those two metrics you create a scale. How much you have spent to acquire a customer and how much he will spend when he becomes a customer. Obviously, our goal is to have the lowest possible CAC and the highest possible LTV.

A positive balance would look like this:

Little is spent to acquire new customers and maximum value is obtained from it. On a negative scale it would look like this:

The cost of getting a new customer is not offset by the value it brings to your business. Money is lost.

ROI – Return on investment

This metric will show the balance, positive or negative, that an investment had. Yes! The search for a new customer is an investment, and the ROI should be evaluated like any other investment. Then:

ROI = Turnover generated – (investment + operating cost)

In the cost of operation we include the Cost of acquisition.

How to get a positive scale

The goal of always keeping the cost of acquiring new clients low should be a command in any agency. Here are some suggestions of what you can do as a manager to increase the Lifetime Value and decrease the Acquisition Cost (green arrows):

To increase the Lifetime Value:

- Keep the client active and satisfied so that they do not stop billing for you.

- Look for clients who spend recurringly (instead of one-off projects).

- Sell other services to your current customers.

- Readjust your values according to the market.

How to reduce the cost of customer acquisition? 7 practical tips

1. Segment your audience

For marketing campaigns to be more effective, it is important that your target audience is well segmented. For this, the company can use tools such as the profile of the ideal client and the people.

This is beneficial because, by knowing the type of customer that matters to the company, it will be possible to concentrate efforts on attracting these people or businesses, without wasting energy on those who do not meet these prerequisites.

More information: Target audience, ideal person for the customer and the buyer: what is the difference between a?

2. Invest in Relationship Marketing

Once you’ve attracted that ideal customer profile, you should stay close to them to keep them close for longer. A strategy that helps reduce the cost of customer acquisition is Relationship Marketing, whose objective is to turn customers into true fans of the company.

This can be done through Email marketing strategies, social networks, loyalty programs and other channels.

Learn more: Relationship marketing: everything you need to know to build customer loyalty

3. Improve website conversions

Do you take advantage of all the conversion possibilities that your website offers?

Just generating traffic is not enough, it is necessary to capture the contact information of these visitors. And of course, rate these leads. These qualified leads are closer to the funnel and by quickly converting to customers will help reduce CAC.

To improve the conversion rate of your website, a tip is to do A / B Test, modifying, for example, the Call-to-Action, the colors, the design and other elements of the pages.

Learn more: What is the A / B Test and what can you test?

4. Invest in after sales

After sales play an important role in reducing the cost of customer acquisition, as it also helps in loyalty.

The company can have quality support, show the customer how to make better use of the product or service, give gifts to older customers, create post-sale content, among other strategies.

5. Take advantage of current customers

Have you thought about taking advantage of current customers to attract others and thus reduce the cost of customer acquisition?

Using your current customer base costs a lot less than attracting new customers from scratch! If your current customers are loyal , they can refer friends and family to the company. Therefore, take advantage of your more evangelizing clients to attract other potential consumers.

6. Reduce the cancellation fee

The reduction in the churn rate (the dreaded Churn ) is also related to the reduction in CAC.

The customers who cancel are usually those who did not see the value in the product or service and who were not loyal, which goes against what is recommended to reduce the cost of customer acquisition. Therefore, reducing the churn should be part of your strategy.

7. Make good content

The content can be of low quality for several reasons: because it is poorly written, because it is superficial or because it is not related to the problems that your potential customers really face, without adjusting to the company’s strategy.

When you meet all of these prerequisites and therefore have quality, your content helps to attract the best potential customers to your blog or other channels. These materials satisfy the needs of these people, making them see your company as an authority and recognize, in your product or service, a solution to their difficulties.

In addition to attraction, good content serves to nurture these contacts throughout the funnel, increasing your chances of reaching the bottom and becoming customers. And the best part is that the same content can be used multiple times, which also reduces costs.

Ultimately

Finally, you will discover a new way to generate new business. It can be difficult to adapt, but it is certainly more difficult to stick with a strategy that is bringing losses. The actions I cited here are just some of the things you can do.

Think, in a general way, about how you can spend less to acquire a new client and how you can earn more with it. On our blog, we talk about different ways to do that with Inbound Marketing. Find your formula and put it on paper to make sure you are being realistic.

Do you know of any other practices to improve this balance? Share it with us in the comments!

Good business!

This post was originally written by Gabriel Schuler in Portuguese and contains adaptations made by the author for the Latin American and Spanish market.

Tags:

- Digital Marketing Strategy

- Agencies